Freelance Isn’t Free Act: Double Damages For Freelancers

Protect Your Rights with an Independent Contractor Attorney

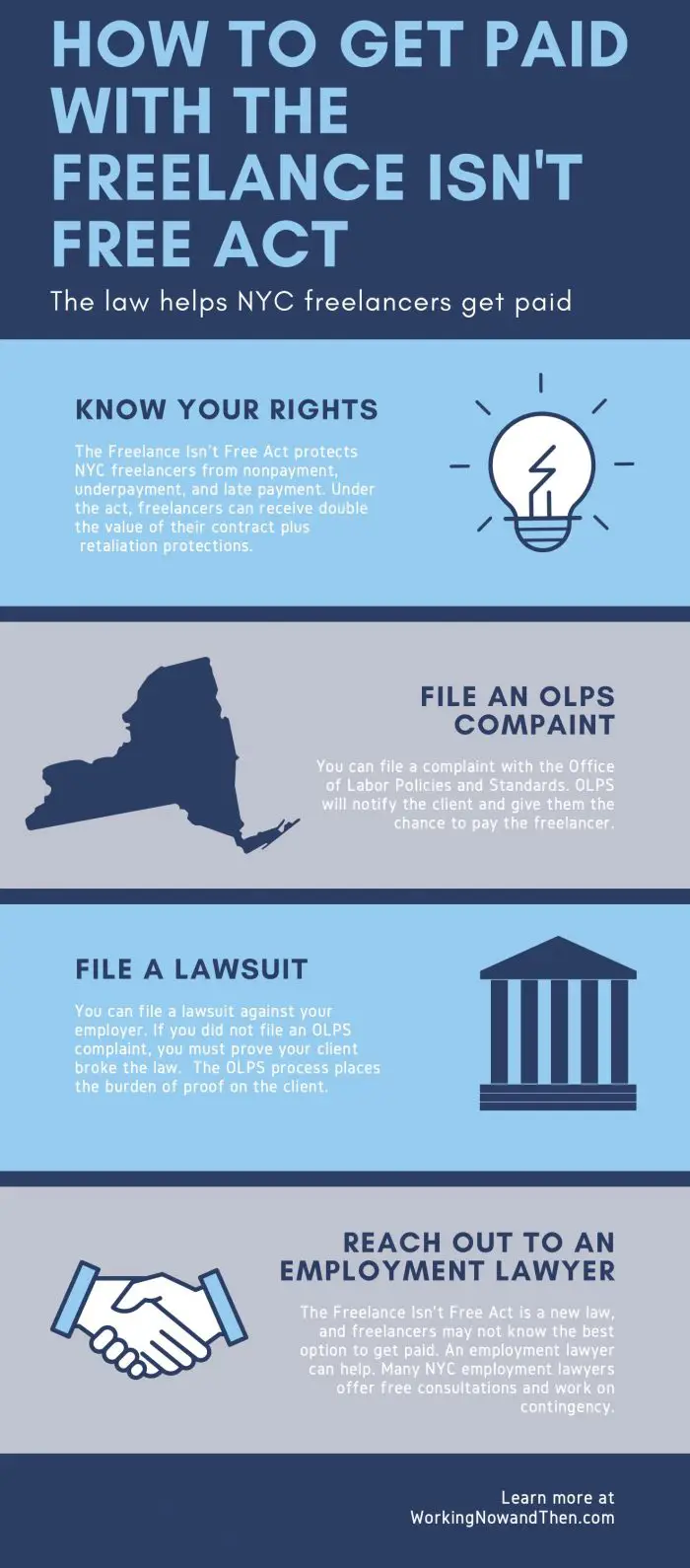

New York freelancers, contract workers, and independent contractors have a payment protection law: the Freelance Isn’t Free Act.

New York’s Freelancer Act is one of the strongest laws protecting gig workers and freelancers in the country. It provides damages for violations of independent contractor rights.

Freelancers can receive double the value of the entire contract for late payment, underpayment, or non-payment.

Freelancers often struggle with late payment, underpayment, or non-payment. The Freelance Isn’t Free Act offers strong protections if clients violate the contract.

You can receive double damages – or twice the value of the contract – if your client refuses to pay, underpays, or pays even a day late.

In other words, your client must pay the value of the contract plus a penalty equal to the value of the contract.

Freelancers who face retaliation, harassment, or intimidation can receive the full value of the contract for each retaliatory act.

The value of the contract is the value of all work performed for the same client within a 120-day period, plus your expenses.

An independent contractor attorney can help freelancers get paid and receive damages. New York employment lawyer Charles Joseph has 20 years of experience with independent contractor rights, and his firm has recovered more than $200 million for clients.

Contact Charles Joseph today for a free consultation.

Freelance Isn’t Free Act Protections

Penalties Include Double Damages

If the freelancer is not paid on time, they can take the hiring party to court and be awarded double damages – two times what they were supposed to be paid under their contract – even if the hiring party claims services were not completed or performed in a satisfactory manner.

The law also protects freelancers who file a complaint against hiring parties from retaliatory harassment, intimidation, and other threatening behavior, including poor performance reviews.

Freelancers receive reasonable attorney’s fees and costs if they win their case.

Examples of Freelance Isn’t Free Act Penalties

The Freelance Isn’t Free Act protects freelancers from underpayment, non-payment, or late payment. The damages are even higher if the hiring party does not provide a contract or provides a non-compliant contract.

Penalties With No Contract or a Non-Compliant Contract

Under the Freelance Isn’t Free Act, you can receive statutory double damages equal to the amount of the entire contract if your client pays late, underpays, or refuses to pay if you do not have a valid contract.

In other words, the penalty is that your client must pay twice. You receive the contract value, plus a penalty equal to the entire value of the contract for a total of twice the value of the contract.

Examples of Freelance Isn’t Free Act Penalties:

- A construction contractor agrees to a $125,000 project, but the hiring party does not provide a contract. If the hiring party does not pay within 30 days of the project’s completion, the contractor can sue for $125,000 under the contract plus $125,000 in damages, for a total of $250,000.

- A nanny makes a verbal agreement to work for an annual rate of $60,000. She doesn’t receive a contract in writing, but the family pays on time for the first few months. Then the nanny receives a late check. She is entitled to damages of $20,000 for the contract value during a 120-day period plus double the value of the late check.

- A graphic designer agrees to work on a project for a $20,000 flat fee. The hiring party provides a contract but leaves out the method of compensation and the date of payment, violating the Freelance Isn’t Free Act contract provisions. The client delays payment past the 30-day legal limit. The graphic designer can receive $20,000 for the value of the contract, $20,000 in damages for non-payment, plus $20,000 in damages for a non-compliant contract, for a total of $60,000.

Non-payment, Underpayment, or Late Payment with a Valid Contract

Even with a valid contract, the Freelance Isn’t Free Act offers protections for underpayment, non-payment, or late payment. Freelancers can receive damages up to double the amount of their contract.

Examples of Freelance Isn’t Free Act Penalties:

- A web designer signs a contract with a company for $30,000. After completing the work, the client refuses to pay. The designer can receive $30,000 from the original contract plus damages of $30,000, for a total of $60,000.

- A videographer signs a contract to make a video for $20,000. The client says she isn’t happy with the final video and underpays the videographer by only paying $15,000. Under the Freelance Isn’t Free Act, the videographer can receive $5,000 on the original contract plus a penalty of $5,000, for a total of $25,000.

- A writer agrees to a ghostwriting project for $10,000. After submitting the finished work, the client pays a day late. The writer can receive a $10,000 penalty under the Freelance Isn’t Free Act in addition to the $10,000 already received, for a total of $20,000.

Retaliation and Harassment

The Freelance Isn’t Free Act also protects freelancers from acts of retaliation and harassment. This can include penalizing the freelancer, threats, or attempts to blacklist the freelancer in an effort to stop the freelancer from exercising their rights.

Hiring parties also cannot deny freelancers future work if they file a complaint under the Freelance Isn’t Free Act or threaten to sue the freelancer for exercising their rights.

Examples of Freelance Isn’t Free Act Penalties:

- A consultant works for a client with a contract worth $100,000. When the client misses a $25,000 payment, the consultant files under the Freelance Isn’t Free Act. The client threatens to end the contract if the consultant continues the lawsuit. The consultant can receive $25,000 for non-payment and a $25,000 penalty, plus $100,000 for the retaliation, for a total of $150,000.

- A contractor signs a contract for a remodeling project for $50,000. After completing the remodeling, the hiring party only pays $25,000. When the contractor files under the Freelance Isn’t Free Act, the hiring party threatens to counter-sue and says they will blacklist the contractor. The contractor can receive $25,000 for underpayment plus $50,000 for the threat to counter-sue and $50,000 for the threat to blacklist. The contractor is owed $125,000.

- A translator signs a contract for translation services for $10,000. After finishing the job, the client says they don’t want to pay. The client harasses the translator and threatens to give a poor review if the translator files under the Freelance Isn’t Free Act. The translator can receive $10,000 for the contract, $10,000 for the non-payment penalty, $10,000 for harassment and $10,000 the threatened retaliation. The client now owes $40,000.

Freelancers Have Up To Six Years to File a Claim

Freelance workers must file a complaint within two years of the violation for failure to provide a written contract. Freelancers have six years to file a complaint about non-payment, underpayment, or an act of retaliation.

Freelancers can take their claims to court or file a complaint with New York City’s new Office of Labor Standards (OLS). Hiring parties found to have breached a written contract can be fined $250. Repeat offenders could face legal action from the City and OLS, as well as civil penalties up to $25,000.

Outside of New York City, New Yorkers can file a complaint with the New York State Attorney General.

These government offices can help collect what you are owed under the contract. However, to collect double damages, you must proceed to court.

Hiring Parties Must Provide A Contract

The law requires that the contract between the freelancer and the hiring party be in writing. The contract must include:

- The parties’ names and mailing addresses

- An itemization of services to be provided

- The “value of services to be provided”

- A description of the rate and method of compensation

- The date when the “hiring party” must pay the compensation or the “mechanism by which such date will be determined”

Once the freelance worker has started performing services under the contract, the hiring party is not allowed to demand that the freelancer accept less money in order to be paid on time.

Freelancers have the right to be paid by the due date in the contract. If there is no due date, the hiring party must pay the freelancer within 30 days after completion of the services listed in the contract.

The Freelance Isn’t Free Act Covers Most Freelancers

The law covers any contract between a freelance worker and a “hiring party,” where the contract has a value of $800 or more, by itself or when aggregated with all contracts between the parties over the past 120 days.

For example, you perform four jobs for one client over the past four months, two for $100 each and two for $300 each. You have protections under the Freelance isn’t Free Act

The Freelance Isn’t Free Act covers freelance workers regardless of their immigration status.

A “hiring party” is any person, organization, or entity that hires a freelance worker. It does not include any local, state, federal, or foreign government. The hiring party does not have to be headquartered in New York City to fall under the Act’s protections.

FAQ About the Freelance Isn’t Free Act

What is the Freelance Isn’t Free Act?

In New York, independent contractors have legal protections under the NYC Freelance Isn’t Free Act and the NY Freelance Isn’t Free Act. Under these laws, freelancers must receive a written contract outlining the service they will provide and the rate.

The Freelance Isn’t Free Act gives independent contractors the right to be paid by the contract due date, and freelancers can file a claim to receive double the contract amount if the hiring party refuses to pay, underpays, or pays late. These freelance laws also grant attorney fees and costs to freelancers who win their claims.

Freelance Isn’t Free requires a written contract if a freelancer performs $800 or more of work in a four-month period. Clients must pay freelancers within 30 days of finishing the contracted services, unless there is a specific date for payment in the written contract. The law also bars clients from offering freelancers less money in exchange for a quicker payment.

Under the Act, clients cannot retaliate against freelancers who pursue non-payment or underpayment claims.

Who does the Freelance Isn’t Free Act cover?

The Freelance Isn’t Free Act covers all individuals hired or retained as independent contractors for pay. This includes individuals who use a trade name or are incorporated.

Common industries that fall under the NY freelance law include media, television, and film; IT, tech, and web design; construction; and childcare.

However, the act does not cover organizations of more than one person.

Also, the Act does not cover three types of freelancers: sales representatives, licensed practicing attorneys, and licensed medical professionals. The act also does not apply to freelancers hired by a federal, state, local, or foreign government.

What are my rights under the Freelance Isn’t Free Act?

Under the Freelance Isn’t Free Act, independent contractors in New York must receive a contract for work that has a value of $800 or more.

The contract must list the freelancer’s and the client’s names and addresses, a list of services and their value, a description of the rate and method of compensation, and the deadline.

If the client does not pay the freelancer by the deadline, or within 30 days of the completion of the services, freelancers can file a lawsuit. The court can award freelancers up to double the stated amount in the contract, even if the client claims the services were incomplete or not satisfactory.

Freelancers have six years to file a complaint under the NYC freelance law for non-payment, underpayment, or an act of retaliation. Freelancers can also file a complaint if they do not receive a written contract.

Was the Freelance Isn’t Free Act signed?

Yes; Mayor Bill de Blasio signed New York City’s Freelance Isn’t Free Act into law on November 16, 2016. The law, which provides protections for NYC freelancers, went into effect on May 15, 2017.

Freelancers can use the Act to enforce payment on contracts signed after May 15, 2017.

The state-wide Freelance Isn’t Free Act was signed by New York Governor Kathy Hochul on Nov. 22, 2023 and went into effect on Aug. 28, 2024.

What is the Freelance Isn’t Free Act effective date?

The NYC Freelance Isn’t Free Act went into effect in New York City on May 15, 2017. The state-wide Freelance Isn’t Free Act went into effect on Aug. 28, 2004.

Under these laws, people who hire freelancers must provide a written contract that describes the services and the deadline for completion of the contract.

Freelancers can file a claim for non-payment, underpayment, or an act of retaliation. They can also file a claim if they do not receive a written contract.

Is the Freelance Isn’t Free Act retroactive?

No, the New York Freelance Isn’t Free Act is not retroactive.

The requirement that freelancers receive a written contract for work that exceeds $800 in a 4-month period went into effect in NYC on May 15, 2017 and state-wide on Aug. 28, 2024. Freelance work contracted before that date does not have to follow the Act’s requirements.

How long do I have to file under the Freelance Isn’t Free Act?

The Freelance Isn’t Free Act lets freelancers file for underpayment, non-payment, or late payment for six years after the contract date. Freelancers also have two years to file for not receiving a contract under the NYC freelance law.

However, the act went into effect in NYC on May 15, 2017 and state-wide on Aug. 28, 2024. Contracts signed before that date are not covered under the Freelance Isn’t Free Act.

While freelancers have six years to file, in general filing sooner is better.

Where can I find a Freelance Isn’t Free Act sample contract?

Under New York’s Freelance Isn’t Free Act, clients must provide a written contract for freelancers who perform at least $800 of work within a 120-day period. The contract must include:

- The name and mailing address for the freelancer and the client

- An itemized list of services to be provided

- The value of the services

- A description of the rate and method of compensation

- The date when the client will pay the freelancer

New York City provides a model freelancer contract that meets the law’s requirements. The New York Department of Labor also has a model freelancer contract.

What are the Freelance Isn’t Free Act regulations?

Under the Freelance Isn’t Free Act, NY freelancers must receive a written contract that details the date they will receive payment for their services.

The NY freelance law includes fines for clients who do not provide a written contract, including penalties up to $25,000 for repeat offenders. The Act also states that freelancers must receive payment within 30 days of completing the work.

The Freelance Isn’t Free Act also includes anti-retaliation provisions, barring clients from retaliating against freelancers who use the Act to receive payment.

Freelancers can file in court to collect double damages, or double the amount owed in the contract, plus attorney fees.

What can freelancers do if their rights are violated?

The Freelance Isn’t Free Act offers protections for freelancers in New York.

Under the Act, NYC freelancers can file a complaint with the city’s Office of Labor Standards for up to two years if they do not receive a written contract, or up to six years for non-payment, underpayment, late payment, or an act of retaliation.

However, the Office of Labor Standards has limited enforcement rights for the NYC freelance law. The office does not award the double damages to which you are entitled. To recover these lucrative damages, twice the contract value, you must proceed to court.

Outside of New York City, freelancers can file a complaint with the New York State Attorney General.

Freelancers who have not received payment can contact a lawyer to protect their rights. The Freelance Isn’t Free Act covers attorney fees for freelancers who successfully receive payment on their claims.

Learn more about independent contractor protections, legal penalties, and filing a claim.

Workers’ Rights FAQs