Wage Protections for Undocumented Workers

July 6, 2018

FLSA wage protections also apply to immigrants and undocumented workers

Genevieve Carlton, Ph.D

The Fair Labor Standards Act (FLSA) provides critical federal protections against wage theft by employers. Workers who are paid less than minimum wage or denied overtime pay can receive back pay and penalties under the FLSA by filing a claim with the Wage and Hour Division (WHD) of the U.S. Department of Labor.

These provisions do not just apply to U.S. workers, permanent residents, and immigrants with work visas. The FLSA also protects undocumented workers who have been denied wages or overtime. And a recent U.S. District Court case reaffirmed wage protections for undocumented workers in New York.

FLSA Protections

The FLSA establishes a federal minimum wage, guarantees overtime pay in certain industries, sets record keeping rules, and mandates standards for child labor. The rules apply to both full-time and part-time workers, regardless of whether they work in the private sector or in government. Because the FLSA is a federal law, it applies across the country.

At the federal level, the FLSA outlaws common forms of wage theft, including denying workers the minimum wage or refusing to provide overtime pay. By protecting workers in every sector of the workforce, the FLSA acts as one of the most important wage protection tools for workers.

The History of the FLSA

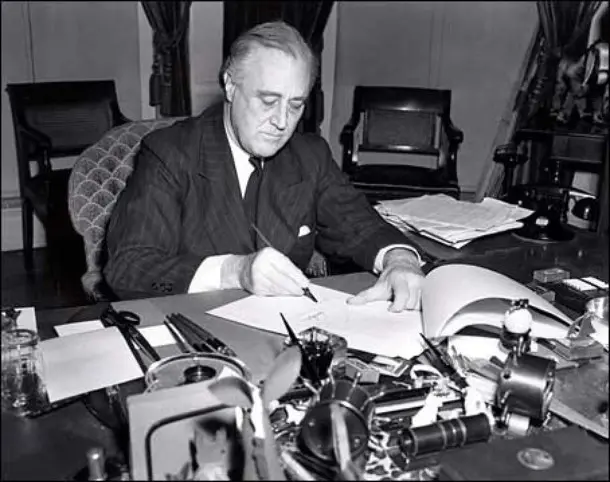

President Franklin D. Roosevelt signing legislation in 1941.

The Fair Labor Standards Act of 1938, signed by President Franklin D. Roosevelt in the last years of the Great Depression, promised wage protections for thousands of American workers. The FLSA banned certain child labor practices and set a cap on the maximum workweek before overtime pay at 44 hours. It also established a minimum hourly wage of 25 cents.

At the time, the bill faced opposition from those who claimed it would harm the economy. The National Association of Manufacturers even claimed the FLSA “constitutes a step in the direction of communism, bolshevism, fascism, and Nazism.” Roosevelt warned Americans to ignore the “calamity-howling executive with an income of $1,000” claiming that “a wage of $11 a week is going to have a disastrous effect on all American industry.”

Since 1938, the federal government has raised the minimum wage twenty-two times. The last increase of the federal minimum wage occurred in 2009, when it was set at $7.25 an hour. Since the last federal minimum wage increase, the minimum wage lost almost ten percent of its purchasing power because of inflation.

FLSA and Immigrant Workers

FLSA protections also apply to immigrant workers. The Immigration and Nationality Act extends wage protections to immigrants working in the U.S. under different visa programs, including H-1B, H-1C, and H-2 visas. The WHD ensures that these immigrant workers receive minimum wage and overtime protections.

For example, immigrant workers on an H-1B visa can file a complaint with the WHD if their employer refuses to pay minimum wage or overtime. The WHD then investigates the complaint and orders the employer to pay back wages if they have violated the FLSA.

Undocumented Workers and the FLSA

Wage protections under the FLSA do not just apply to American citizens, permanent residents, and and immigrants with visas. They also cover undocumented workers. The WHD enforces FLSA protections for undocumented workers who were underpaid for labor already completed.

However, the 2002 Supreme Court ruling in Hoffman Plastics Compounds v. National Labor Relations Board determined that federal protections do not guarantee back pay for time an undocumented employee would have worked if he had not been wrongfully terminated. The FLSA, by contrast, covers hours actually worked. As a result, the WHD continues to enforce wage protections for undocumented workers.

New York FLSA Protections

Recently, the U.S. District Court for the Southern District of New York reinforced wage protections for undocumented workers. In Saavedra v. Mrs. Bloom’s Direct (2018), the court found that Luna Saavedra, an undocumented worker, was owed $25,000 in unpaid overtime and other wage violations.

Daniel Patrick Moynihan U.S. Courthouse, where the U.S. District Court for the Southern District of New York hears cases.

In Saavedra’s case, her employer, a flower company, claimed that they did not have to pay the settlement because they suspected Saavedra was undocumented. The company argued that the court should nullify the settlement if Saavedra was an “illegal alien.”

The court ruled that “court orders or settlements requiring payment of back wages under the FLSA to undocumented person have been approved by the Second Circuit,” which found that the policy ‘“ensures that the employer does not take advantage of the [immigration] violation by availing himself of the benefit of undocumented workers’ pat labor without paying for it.’”

In New York state, the court ruled, “the precedent . . . is clear that the immigration status of a plaintiff-worker is irrelevant under the FLSA.”

The ruling reaffirmed that all New York workers, including undocumented workers, have protections under the FLSA.